A 5-Part Lesson.

Gamma Exposure (GEX) sounds complex, but at its core, it’s just a way of mapping where option dealers are most exposed and how their hedging can push price around.

In this 5-part lesson, we’ll walk through:

- Who the main players are

- What delta and gamma actually mean

- What GEX is and why it matters

- How GEX shapes real price action

- How to use Bullflow to visualize GEX in real time

——————————————————————————————————————————

👥 Lesson 1: The Players in the Options Market

Before we talk about Gamma Exposure (GEX), you need to know who is involved in the options market and how their roles shape the game.

1. Retail Traders

Retail = your typical individual investor who trades with their own personal money through a brokerage and usually does so on a casual or part-time basis, not as a professional or institution. They typically buy calls when they’re bullish, and puts when they’re bearish, or (some traders) sell options when they want income.

Example:

- NVDA is trading at $175.

- A retail trader buys a $185 strike call expiring this Friday because they think it’s going to rip (based on technical analysis or whatever thesis they have)

That trade itself doesn’t move the market because it's too small. Even if they bought 50 calls, it wouldn’t move the market. But when thousands of traders pile into those same strikes, it starts to add up. Market Makers (Dealers) who sold those calls to retail are now short a lot of NVDA $185 calls, and they’ll need to hedge, more on that soon.

- Retail is long calls

- Dealers are short calls

Delta measures how much an option’s price is expected to move when the underlying stock moves by $1.

Lets just assume that the 185 strike call is 50 delta. So if they sold 10,000 of these calls to retail, the dealers are now short 500,000 delta (5010,000). In other words, their position goes up/down $500k for every $1 move in NVDA). This is a big risk, obviously.

2. Institutional Traders

These are hedge funds, pensions, and big asset managers. They’re trading 10,000 contracts at a time, not 10. They use options both to hedge and to speculate.

Example:

- TSLA is trading at $320.

- A hedge fund holding millions of dollars in Tesla stock buys 20,000 contracts of $300 strike puts expiring next month to protect against downside.

They are essentially using their puts to hedge their long position, not necessarily for a huge downside move. That massive order hits dealers, who are now short 20,000 puts.

- Institution is long puts

- Dealers are short puts

Again, lets assume the $300 strike puts have a 50 delta, so the dealers are now long 1,000,000 total deltas (5020,000). In other words their short position goes up/down $1M every $1 move in TSLA).

3. Market Makers (Dealers)

They’re not trying to guess where TSLA or NVDA is going nor do they care. Their one and only job is to always take the other side of retail and institutional trades to provide liquidity.

But they have rules and risk management requirements to follow. They can’t just take on unlimited risk of selling naked options. So whenever they sell a position to retail or institutions, they need to hedge their options positions by buying or selling stock/futures.

- If you buy a call, the dealer sells it to you. Now they’re short delta (they lose money if the stock goes up). To neutralize that, they buy shares or futures.

- If you buy a put, the dealer sells it to you. Now they’re long delta (they lose money if the stock goes down). To hedge, they sell shares or futures.

Recap:

- NVDA is $175. A wave of retail buys $200 strike weekly calls.

- Dealers sell those calls, leaving them short.

- Since dealers are short deltas from their option position, they need to buy stock (1 stock = 1 delta) to offset their large negative delta position. i.e. to stay hedged, they buy NVDA stock. If the buying is heavy enough, it actually pushes NVDA higher, making those calls even more valuable.

This is how retail call buying can create feedback loops in momentum names like NVDA or TSLA.

Why This Matters for GEX

Every trade changes the risk profile of dealers. There are millions of traders trading all sorts of strategies, instruments, timeframes, and dollar amounts. That’s essentially the stock market in a nutshell. When options pile up at certain strikes and expiries, dealers have huge exposures.

Gamma Exposure (GEX) shows us those exposure points where hedging will act as levels of interest. If the level holds, then the price might get pinned around that level, if that level gets broken, then price will typically accelerate as dealers reposition.

✅ Lesson 1 Takeaways

- Retail + institutions create the demand for options.

- Dealers are forced to take the other side. Once they take the other side, then they de-risk (hedge) by taking a stock/futures position. This buying and selling stock is what moves price.

- The push and pull between these groups is what makes GEX like a map of where hedging flows are strongest.

——————————————————————————————————————————

🔍 Lesson 2: Delta and Gamma

Now that we know who the players are (retail, institutions, and dealers), let’s talk about the language that explains how dealers hedge: delta and gamma.

In Lesson 1, we covered how dealers hedge their positions whenever retail or institutions open new option positions. But price never stays still. As the underlying stock moves, the Greeks shift, and those changes directly alter the dealer’s risk exposure.

1. What is Delta?

Delta is how much an option’s price moves when the stock moves $1.

- A 50 delta call means if the stock goes up $1, the option goes up about $0.50.

- A -50 delta put means if the stock goes up $1, the option loses about $0.50.

Delta also represents share equivalence.

- A 50-delta call = owning half a share.

- A 70-delta call = like owning 0.7 shares.

- A 30-delta put = like being short 0.3 shares.

This is why dealers hedge. If they sell 10,000 contracts of 50-delta calls, they’re now short 500,000 deltas, which is the same as being short 500,000 shares.

They need to buy 500,000 shares (or the equivalent in futures) just to get back to neutral, or whatever their risk parameters require.

Example: $NVDA

- NVDA is trading at $175.

- Retail piles into $185 weekly calls expiring Friday (50 delta).

- Dealers sell 10,000 contracts to them.

- Each contract is 100 shares → 10,000 × 100 = 1,000,000 share equivalent.

- At 50 delta, dealers are now short 500,000 deltas.

- To hedge, dealers buy 500,000 shares of NVDA.

- Their –500k delta from the short calls is offset by +500k delta from the shares.

Net result: 0 delta (neutral).

If NVDA starts climbing, the calls gain value and their delta increases… which brings us to gamma.

2. What is Gamma?

So if delta measures how much an option’s price changes for a $1 move in the stock, gamma measures how much delta itself changes when the stock moves $1.

- If a call has 0.05 gamma and NVDA goes up $1, the option’s delta increases by 0.05.

- A 50-delta call becomes a 55-delta call after that $1 move.

Gamma is essentially the sensitivity dial for delta.

Why Gamma Matters for Dealers

Dealers don’t hedge just once. They have to constantly adjust as deltas shift from price movement or the passage of time. This is known as dynamic hedging.

When gamma is high (like on 0DTE or near-the-money options), deltas change extremely fast. In other words, the sensitivity knob is turned way up. Dealers are then forced to buy or sell stock aggressively to stay neutral. This is what creates the powerful feedback loops we see in the market.

Example: TSLA

- TSLA is trading at $320.

- A hedge fund buys 20,000 contracts of $300 puts expiring next month (assume 50 delta).

- Dealers sell those puts → they’re now long 1,000,000 deltas (Selling puts = long delta.)

If TSLA drops to $310:

- The puts move deeper in-the-money, and delta increases from 50 → 60.

- Dealers are now long 1.2 million deltas, instead of the original 1.0 million.

- To rebalance, they must sell an additional 200,000 shares of TSLA.

That selling pressure can accelerate the down move, even though it all started from a hedge.

3. Why Delta + Gamma Matter for GEX

Every option carries delta and gamma. When you aggregate them across all strikes and expirations, you can see where dealers are most exposed.

- Large clusters of open interest at certain strikes mean dealers must hedge heavily around those levels.

- High gamma near expiration forces faster dealer hedging, which can either pin price or accelerate moves depending on the direction.

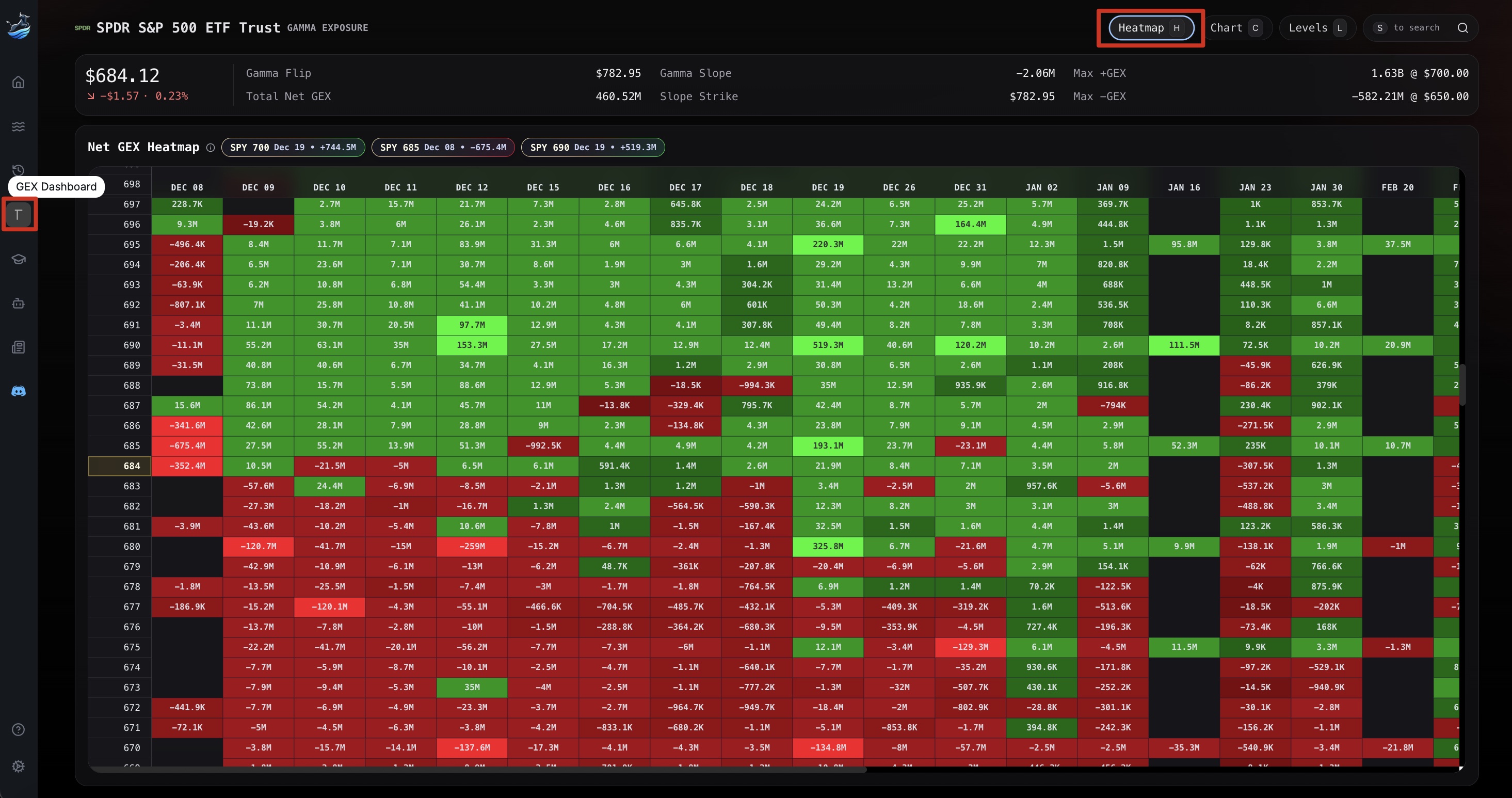

You can see on Bullflow's Net GEX heatmap where dealers are long and short gamma based on the expiration date.

This is the foundation of Gamma Exposure (GEX): it’s a map of all these deltas and gammas stacked up at each strike and expiry.

✅ Lesson 2 Takeaways

- Delta = share equivalence (how much an option mimics stock).

- Gamma = how much delta changes as price moves.

- Dealers hedge deltas. Gamma forces them to keep re-hedging.

- This hedging flow itself moves the market.

——————————————————————————————————————————

⚡️ Lesson 3: What is Gamma Exposure (GEX)?

Now that we’ve covered delta and gamma, let’s put everything together and talk about Gamma Exposure (GEX).

1. What is GEX exactly?

GEX is the total gamma in the market, aggregated by strike and expiration. It gives us a clear view of where dealers are carrying the most exposure.

It’s essentially a heatmap of dealer risk, every options trade adds to that map and shifts the balance.

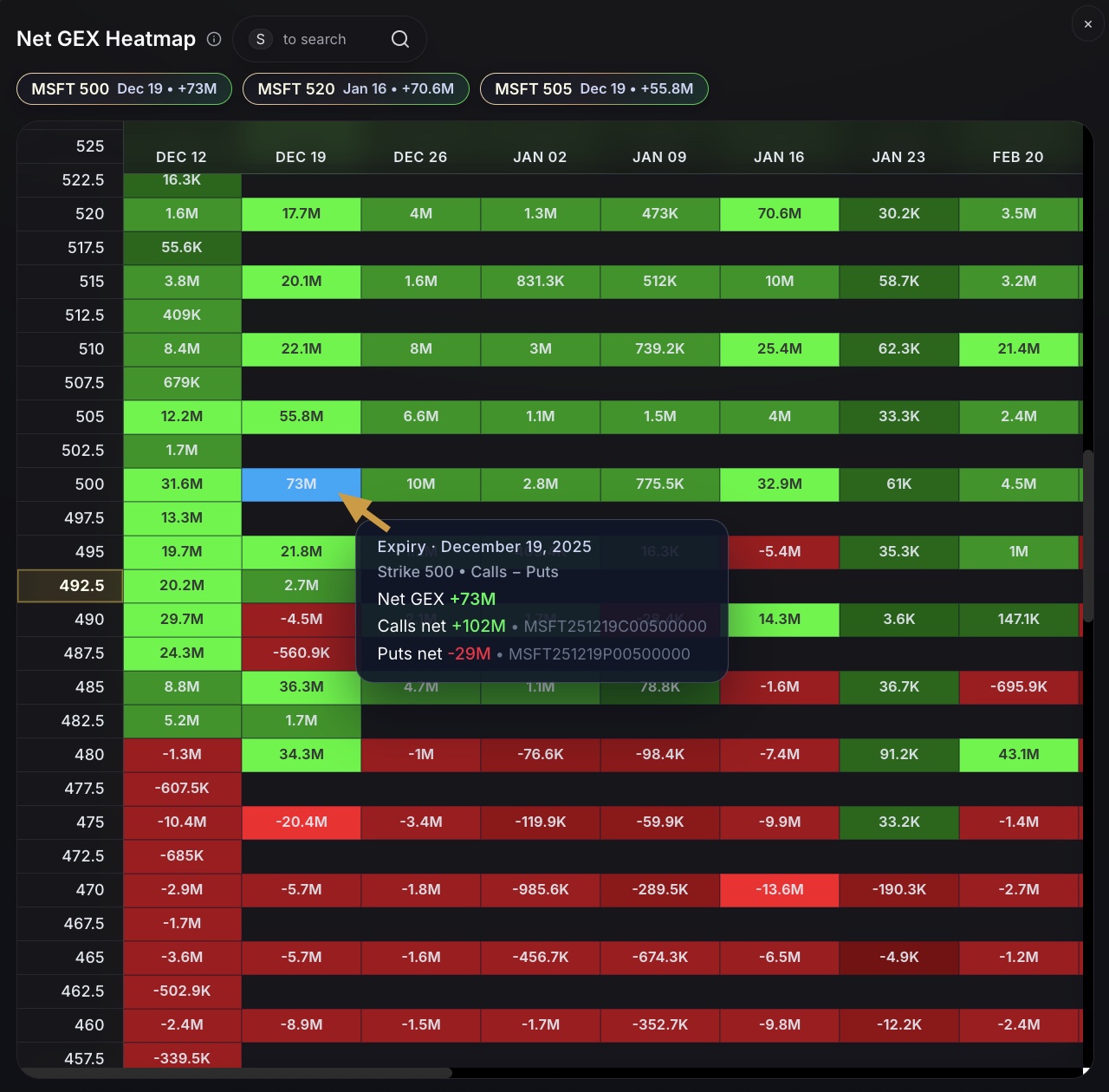

This heatmap is showing the positive and negative net gex values with the highest absolute value highlighted in blue.

Net GEX = Call GEX − Put GEX.

- Green = Positive Net GEX

- Red = Negative Net GEX

- Blue = Highest absolute value (most impactful level)

2. SPX

SPX is where the big players operate.

Funds, institutions, and now a wave of retail traders running 0DTE strategies. With trillions flowing through it every day, dealer hedging in SPX has an outsized impact on intraday price action.

$SPX = monthly expirations.

$SPXW = weekly or daily expirations (0DTE).

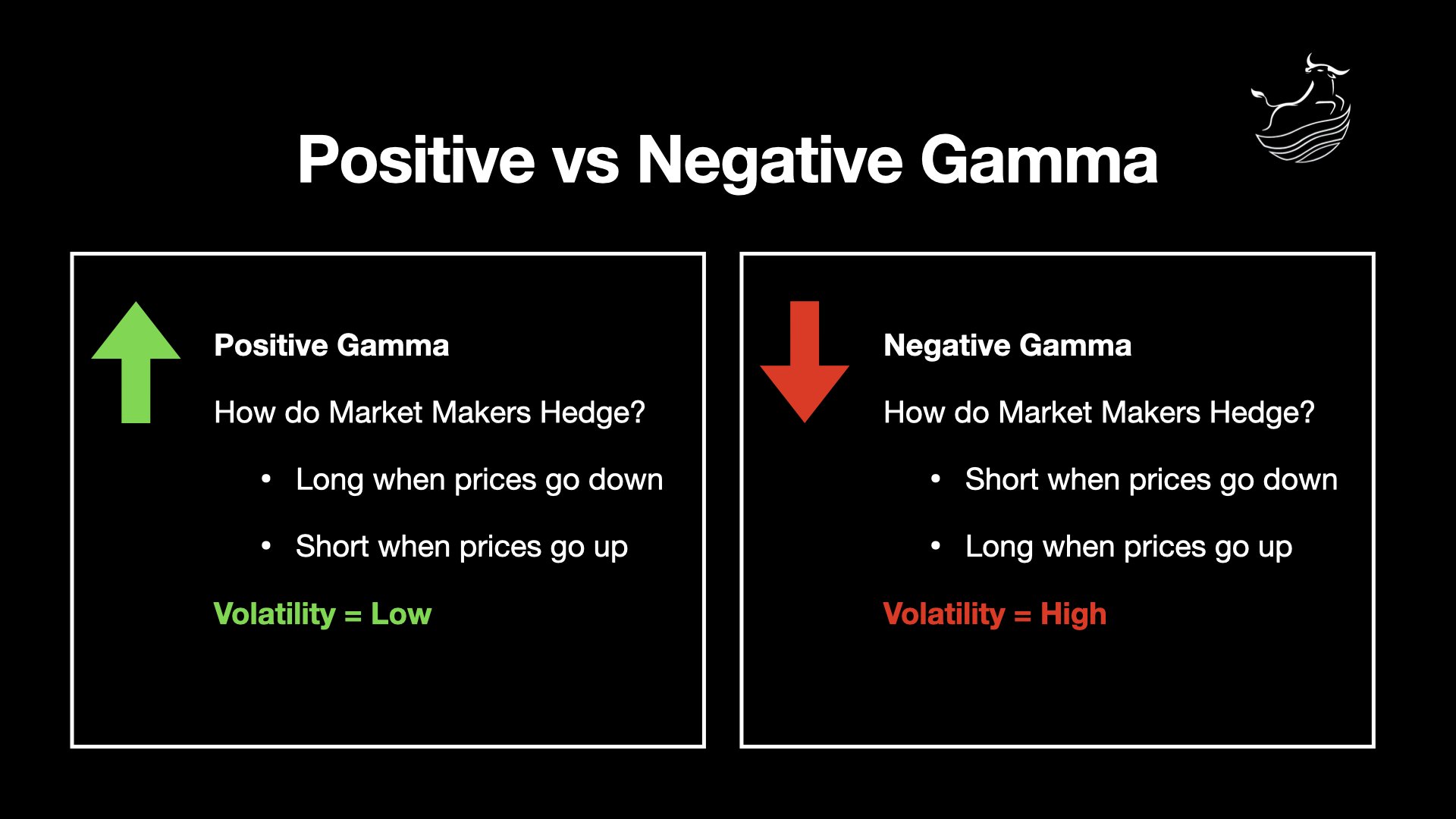

3. Positive vs Negative GEX

Positive (+) GEX environment (dealers long gamma)

When dealers are long gamma, their hedging naturally works against price moves.

- If SPX goes up, call deltas increase. Dealers who sold those calls become more short delta, so they sell futures into strength to stay neutral.

- If SPX goes down, call deltas decrease. Dealers become less short, so they buy futures on the dip to rebalance.

The net effect is simple: dealers are constantly leaning against the move. Their hedging acts like a brake pedal, reducing volatility.

That’s how positive GEX “dampens” volatility. When SPX is going up, the selling pressure from dealers slows the upward movement. When SPX dips, the buying pressure from dealers slows the drawdown.

Negative (-) GEX environment (dealers short gamma)

When SPX goes up, puts lose delta and calls gain delta.

- Dealers end up short deltas, so they must buy futures to keep up.

- When SPX goes down, puts gain delta. Dealers become too long delta, so they sell futures to rebalance.

The net effect is that dealers hedge with the move, not against it. Their hedging acts like an accelerator, which is why negative GEX amplifies volatility (more buying into strength, more selling into weakness).

4. Example: 0DTE Flows

Let’s say it’s Wednesday, SPX is at 6500, and traders load up on same-day 6450 puts ahead of FOMC.

- Dealers sell those puts → they’re now long delta.

- SPX drops to 4975 → those puts gain delta quickly.

- Dealers become too long delta, so they hedge by selling S&P futures.

- Their selling pushes SPX even lower, which increases the value (and delta) of those puts even more → forcing additional selling.

That’s the classic short-gamma feedback loop you get in a negative GEX environment.

5. How to Read the GEX Charts

Strikes are on the y-axis, and expirations are on the x-axis. The yellow-boxed strike is the one closest to the current spot price.

The green areas show where dealers are long gamma. The bright green displays higher positive net gex levels. These zones often act like magnets (positive GEX).

The red areas show where dealers are short gamma. The bright red displays higher negative net gex levels. These zones tend to act as accelerants (negative GEX).

✅ Lesson 3 Takeaways

- GEX = the map of dealer gamma exposure across strikes/expiries.

- Positive GEX dampens volatility: hedging goes against the move (buy the dip regime).

- Negative GEX amplifies volatility: hedging goes with the move (sell the rip regime).

——————————————————————————————————————————

📈 Lesson 4: How GEX Shapes Price Action

Now that we’ve explained delta, gamma, and what GEX is, let’s step back and look at how these pieces interact with real market moves. This lesson is about building the mental model of how GEX influences price action.

1. 📌 Pinning Effect (Positive GEX)

When dealers are long gamma (positive GEX), their hedging fights volatility.

- If SPX ticks up, dealers sell futures to stay balanced.

- If SPX ticks down, dealers buy futures to rebalance.

Net effect: their hedging always leans against the move.

This is why SPX often gets “pinned” around big positive GEX strikes.

Example:

- SPX trading near 6500.

- There’s a massive positive GEX wall at 6500.

- Every attempt to push higher gets met with dealer selling; every dip gets met with dealer buying.

Result: SPX grinds sideways, and 0DTE options bleed premium.

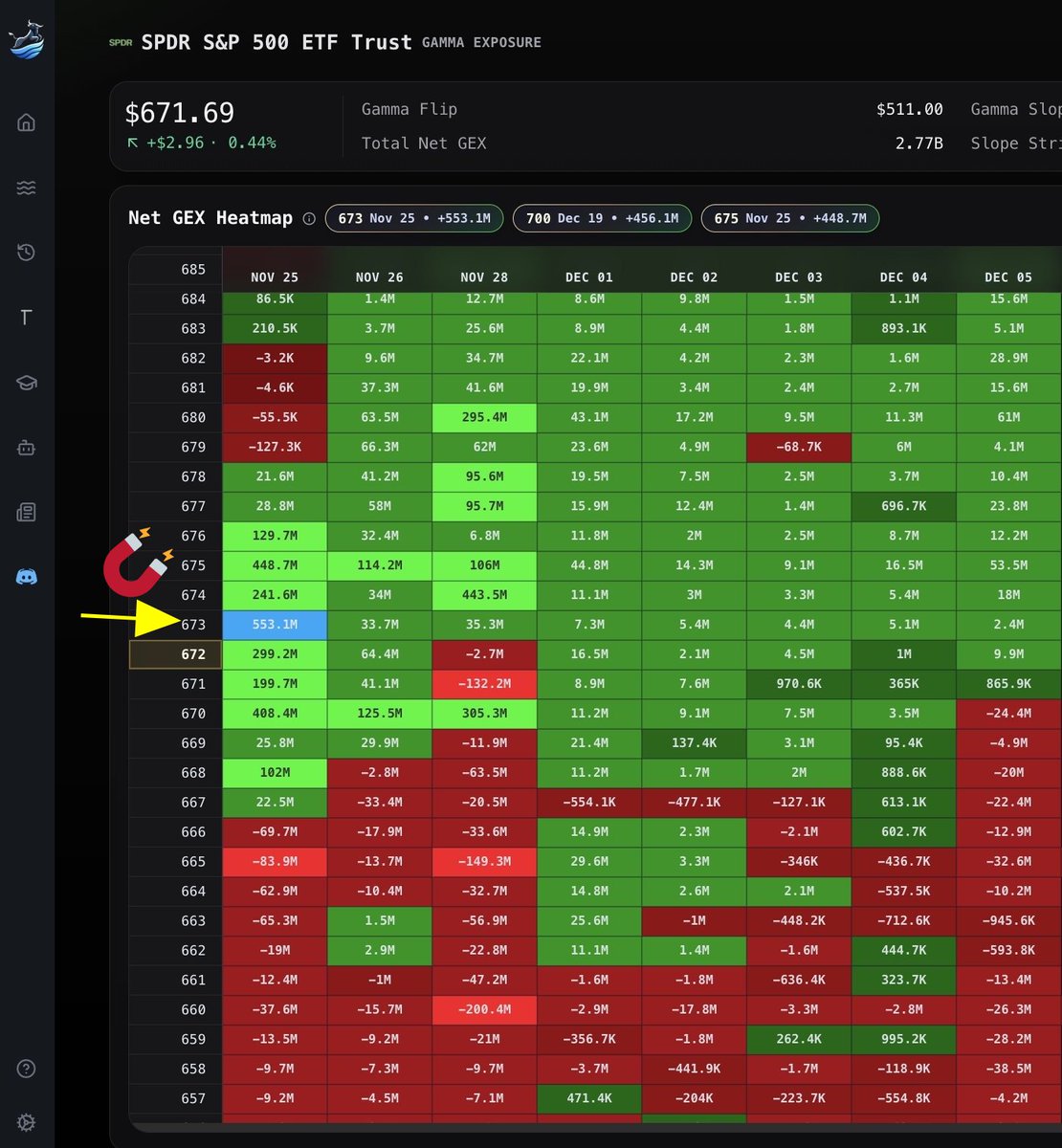

673 is the highest positive net gex zone. Dealers hedge against price moves there which should create stability and reduce volatility. Think of it as a magnetic support zone that slows down selling pressure.

2. ⚡️Acceleration Effect (Negative GEX)

When dealers are short gamma (negative GEX), their hedging chases volatility.

- If SPX ticks up, dealers buy futures to catch up.

- If SPX ticks down, dealers sell futures to rebalance.

Net effect: their hedging leans with the move.

This is why SPX can flush super fast when negative GEX dominates. The phrase “don’t catch a falling knife” is displayed prominently when viewed through a GEX lens.

Example:

- SPX trading at 6450.

- Retail traders pile into 6950 puts (0DTE).

- Dealers sell those puts → they’re long deltas.

- As SPX sells off further, put deltas spike. Dealers are suddenly too long, so they hedge by selling S&P futures.

- That selling pushes SPX lower, which makes the puts even more valuable… forcing more dealer selling.

- A self-reinforcing feedback loop → FLUSH

684 to 687 are clearly high negative net GEX levels. In this zone, dealers hedge with the move. So when price pushes down through these strikes, it forces dealers to sell even more, which increases volatility and accelerates the downside.

3. Expiry Dynamics

Not all GEX is equal. A lot of gamma sits in short-dated options, especially 0DTE contracts. So that’s why GEX is most applicable in 0DTE SPX and Friday 0DTE for equities.

- Before expiry: Dealers are heavily hedged around the big strikes. This keeps the price sticky.

- After expiry: That gamma exposure disappears. Dealers unwind hedges. This can unleash volatility.

Example:

- Friday OPEX: SPX pins at 6000 all day because of heavy positive GEX.

- At the close, those options expire worthless. Dealers no longer need hedges.

- Monday opens with no “glue” at 6000 → price can move more freely.

4. Intraday Context

The influence of GEX isn’t the same all day:

- Mornings (especially on 0DTE heavy days): Dealers are adjusting fast as new positions open. Negative GEX environments often see big morning moves.

- Afternoons: With exposure clearer and liquidity thinner, SPX often drifts back toward the biggest positive GEX strike (the “magnet”). This is the classic afternoon pin.

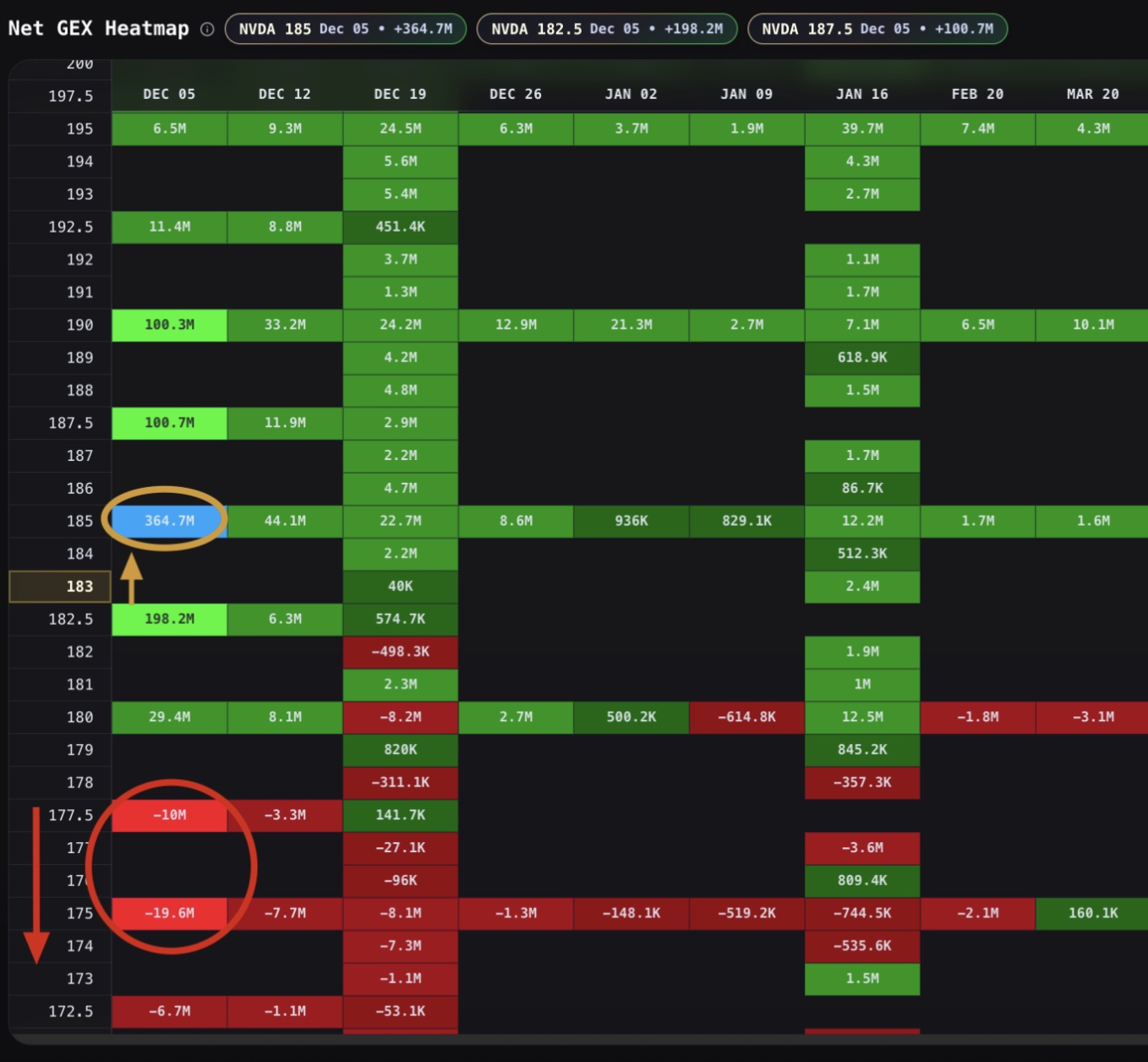

$NVDA Example

Large 364.7M positive net GEX value at the 185 strike.

Look at the $185 strike on Dec 05 (+364.7M), this is the highest absolute value, hence it’s highlighted in blue.

This is a huge positive GEX wall, meaning dealers are long gamma there.

If NVDA moves up toward $185:

- Call deltas increase.

- Dealers who sold calls become more short delta → Dealers sell shares/futures into the rally to stay hedged.

- This slows the move before NVDA can break far above 185.

Net effect: $185 acts like a magnet. The heatmap tells you price is likely to grind, chop, or pin near that level.

📉 Negative GEX Example (Accelerator / Volatility Zone)

Now look at the 177.5–175 zone (–10M, –19.6M), highlighted in red.

This is a cluster of negative GEX, meaning dealers are short gamma.

If NVDA breaks below this zone:

- Dealers must sell even more.

- NVDA can flush quickly through this region.

Net effect:

The 177.5–175 zone is an air pocket. Once NVDA enters it, volatility rises and downside moves can cascade fast.

- Positive GEX at $185 → Expect stabilization, pinning, mean-reversion.

- Negative GEX at 177.5–175 → Expect volatility, acceleration, trending moves.

This is why GEX matters:

It shows where the market is sticky (green) versus where it can break and run (red).

✅ Lesson 4 Takeaways

- Positive GEX → Pinning effect. Price sticks to big strikes.

- Negative GEX → Acceleration effect. Price runs faster once it breaks.

- Expiry → Gamma falling off can free up volatility.

- Time-of-day → Mornings see more hedging shocks, afternoons more pinning.

——————————————————————————————————————————

📊 Lesson 5: How to View Net GEX on Bullflow

Bullflow gives you everything you need to track net GEX in real time:

1. Net GEX Heatmap

This is the core tool for visualizing how gamma is distributed across strikes and expirations. You can access it by clicking any line of flow on the Options Flow Dashboard and selecting “Net GEX Heatmap.” This lets you view the heatmap while browsing flow at the same time.

You can also open the Greeks Dashboard to view all gamma data in a full-screen layout.

This is the same heatmap used in all earlier examples.

2. GEX Levels Bar

Bullflow's Greeks Dashboard allows you to view GEX by both Strike and Expiration.

This shows how much call gamma (yellow) and put gamma (purple) exists.

Gamma Exposure by Strike (left chart) shows you where large positive and negative GEX pockets sit. It also indicates which strikes matter most.

For Example: Strike 700 has huge positive call gamma ($256M).

Gamma Exposure by Expiration (right chart) shows how gamma is distributed across upcoming expiration dates. This will help you identify which days carry the most gamma.

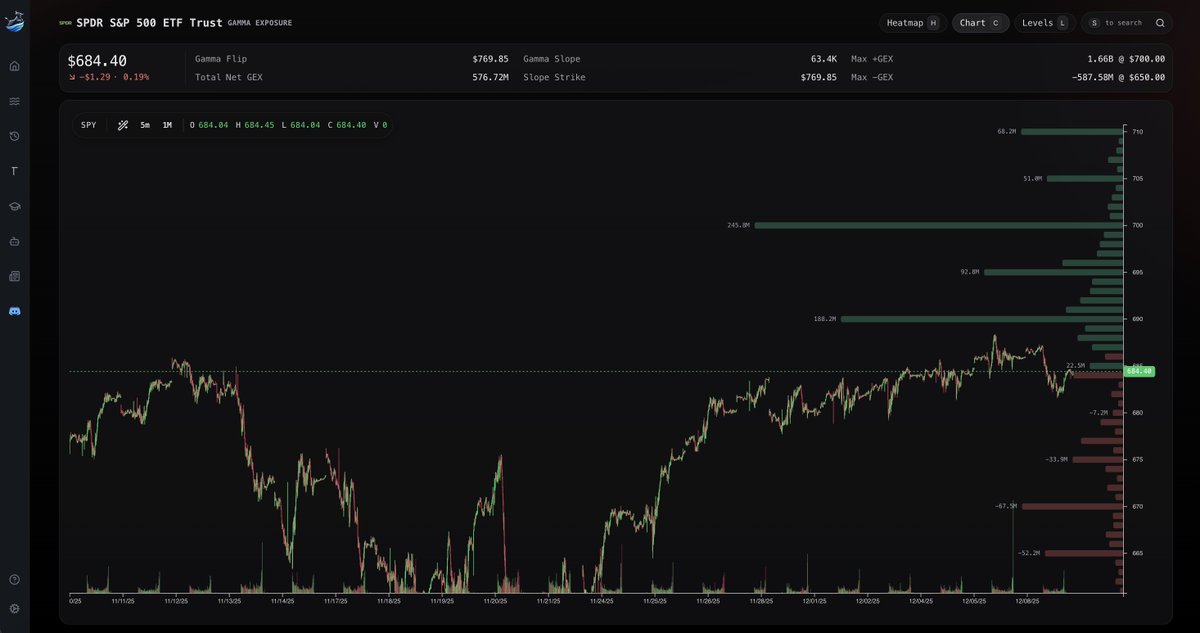

3. Net GEX Chart Overlay

This view lets you identify major net GEX levels directly on the chart while browsing options flow. You can select Net GEX Overlay to add net gex values by strike as well as multiple other technical indicators.

You can also see this from the Greeks Dashboard in a full-screen layout

You can see how price interacts with big net GEX strikes and when price enters a positive/negative gamma pocket.

——————————————————————————————————————————

Special thanks to @yjtung on X for his help in creating this material. He originally posted several in depth write ups on GEX for our Discord members. Be sure to join Bullflow's Discord to get access to ongoing educational material like this!